This project focused on the Authenticate + Pay experience for Verizon’s value brands, supporting both new and existing prepaid customers as they accessed their accounts and refilled service.

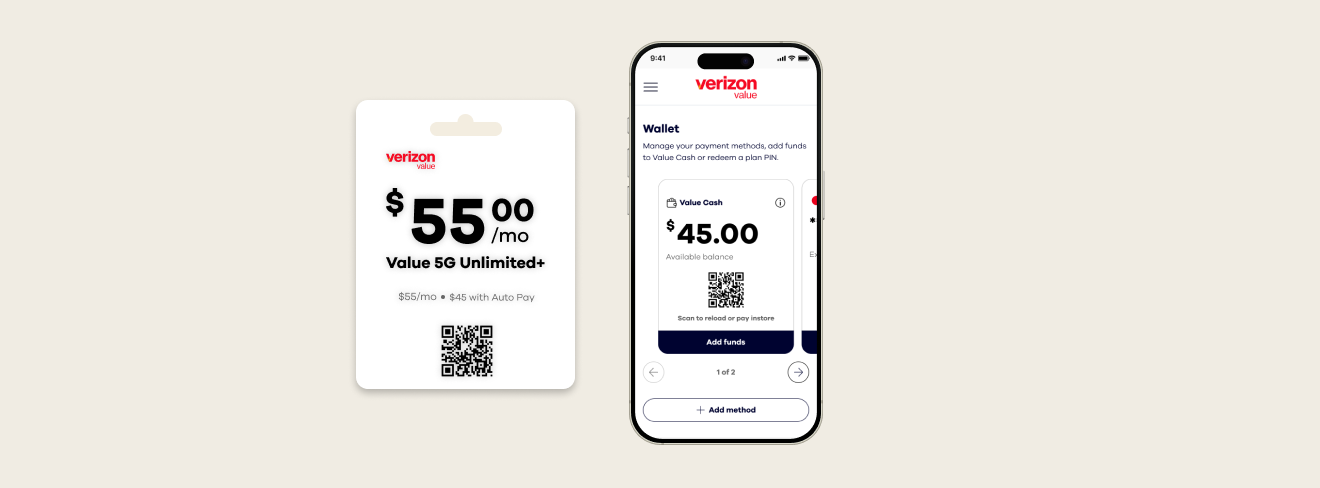

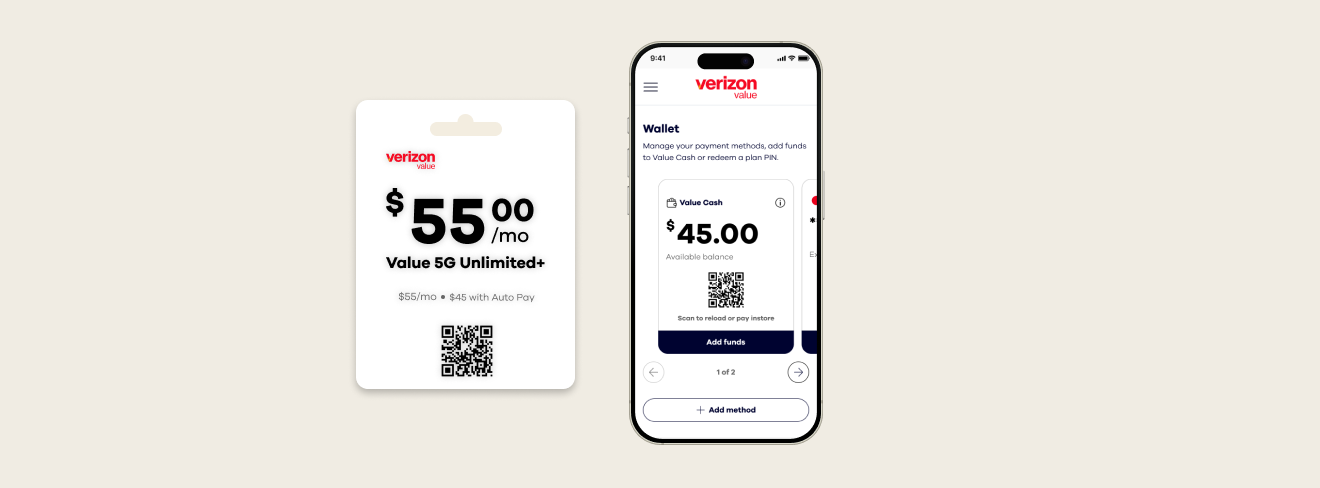

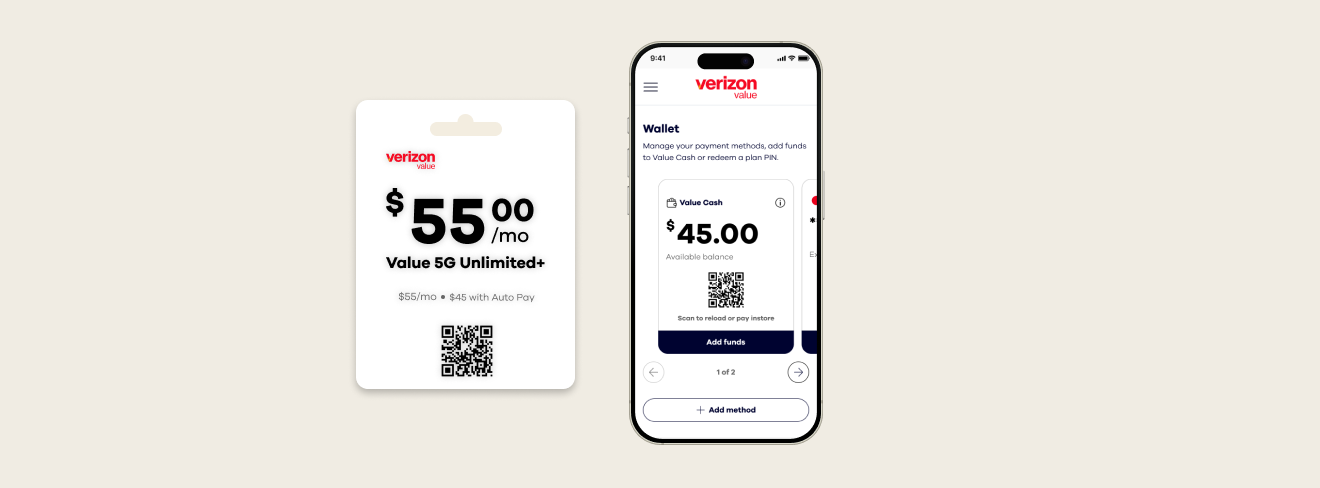

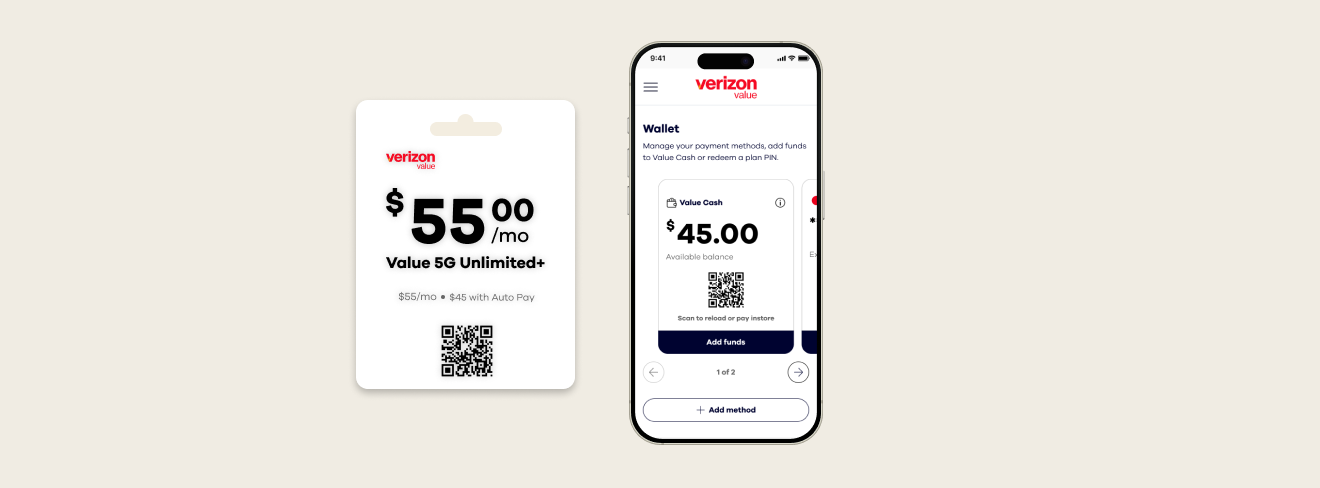

A significant portion of payments occurred in-store via physical PIN cards purchased with cash, creating a disconnect between in-person and digital experiences. The challenge was to enable seamless account access and bill payment from a mobile device while bridging in-store behaviors with online account management.

The experience spanned authentication, billing, and payment systems and was a critical business initiative to reduce service interruptions, improve account creation, and move customers toward more reliable and repeatable digital payment options.

Customers frequently lost service because they were unable to add funds to their accounts in time. Alerts and reminders were unclear, payment options were inconsistent across brands and platforms, and authentication failures often blocked users from completing simple refill actions.

The existing refill journey was fragmented and difficult to navigate, resulting in high abandonment rates—especially for credit card payments—and long session times for what should have been a quick task. Confusing language and unreliable login behavior created anxiety and drove a high volume of emotionally charged care calls.

The experience failed to reflect customers’ financial realities, particularly for cash-based users and those with fixed income schedules.

This challenge extended beyond surface-level UX and required rethinking how multiple systems worked together.

Cash-based PIN card payments existed as a separate path from credit card payments and were not interoperable with digital payment systems. As a result, customers who relied on cash often had no reliable way to see their account balance online, creating friction at a critical moment in their experience and putting them at risk of service loss.

Addressing this gap required more than a technical solution. It meant understanding the real-world contexts in which these customers managed their service, and designing with cultural and economic realities in mind.

The flow also included multiple entry states—logged out, partially authenticated, or operating within expired sessions—meaning any change to authentication or payment behavior had downstream implications across the broader account management ecosystem.

This work needed to operate at enterprise scale, supporting a large and diverse user base with varying levels of digital access and financial flexibility.

The experience was subject to strict security, privacy, and compliance requirements, particularly around authentication and payment handling, which limited how quickly or radically backend systems could change.

There was also a significant disconnect between in-store and online experiences. While many customers paid in cash in physical retail locations, all account management and digital interactions required online payment systems. Bridging these behaviors without breaking existing infrastructure was a key constraint throughout the project.

I served as the lead UX designer for the Authenticate + Pay experience, owning the end-to-end flow across authentication and payment. I was responsible for framing the problem, defining experience principles, and translating complex system constraints into clear, usable patterns.

I partnered closely with product management, engineering, analytics, security, and base management teams to align on priorities, evaluate tradeoffs, and ensure designs were both user-centered and technically feasible.

I also led research efforts to better understand cash-based payment behaviors and the real-world contexts in which customers managed their service, using those insights to inform system-level decisions and guide iterative development.

We began by mapping the end-to-end authentication journey across both existing customer login and new account creation. Working closely with product, business, and analytics partners, we identified key points of friction where customers were getting blocked or dropping out of the experience.

From there, we focused on simplifying access and reducing unnecessary barriers, introducing clearer authentication patterns such as one-time passcode login and integrating familiar payment ecosystems like Apple Pay and Google Pay.

In parallel, we re-examined how payments were collected. We expanded support for common telecom behaviors—including split payment methods, scheduled payments, and more prominent autopay options—to better align with customers’ financial realities.

Taken together, this work allowed the team to reframe the experience as a progressive, connected system rather than a series of fragmented interactions, creating greater continuity from authentication through payment.

This work resulted in a more resilient and flexible Authenticate + Pay experience that better reflected how customers actually manage their service. Authentication and payment flows became clearer and easier to navigate, reducing friction at critical moments and helping customers maintain connectivity with greater confidence.

By bridging cash-based payment behaviors with digital account management, the team established a foundation for supporting a wider range of payment methods and financial realities, including reloadable value balances, split payments, and backup payment options.

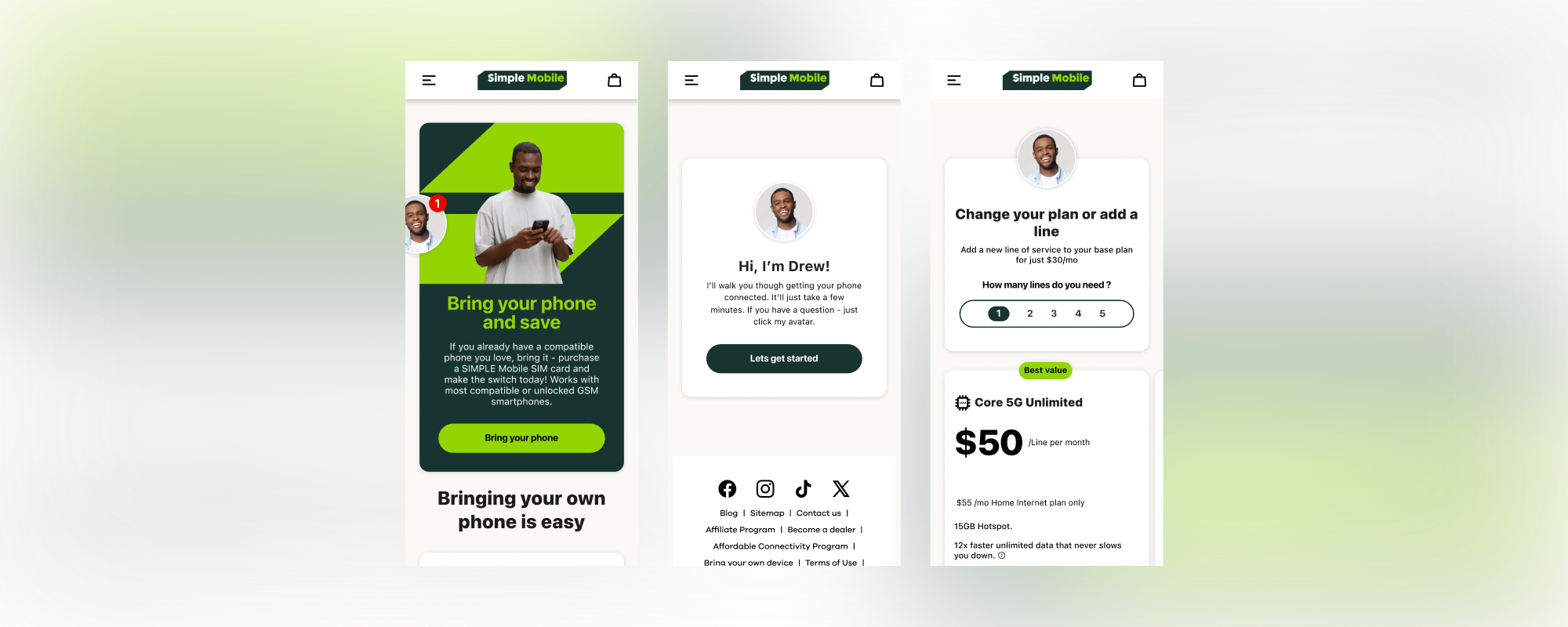

Just as importantly, this work shifted the team from iterative, in-house journey optimization toward a scalable solution designed to support deployment across the broader value brand ecosystem. The patterns and system logic developed here became a blueprint for extending consistent authentication and payment experiences across multiple brands and platforms.